New Income Tax slab for the F.Y. 2020-21, A.Y. 2021-22.

Income tax is calculated on the basis of the slab rate which defines under the Finance Act of the relevant year. The income tax rates are issued by our Finance minister in the budget of every year.

In India Income tax is levied on individual taxpayers on the basis of a slabs. The Slab system means different rate of tax are provided for different range of income. That means whenever persons incomes are increase, simultaneously increase in rates of tax. This type of taxation system called progressive in nature. It may change in every budget.

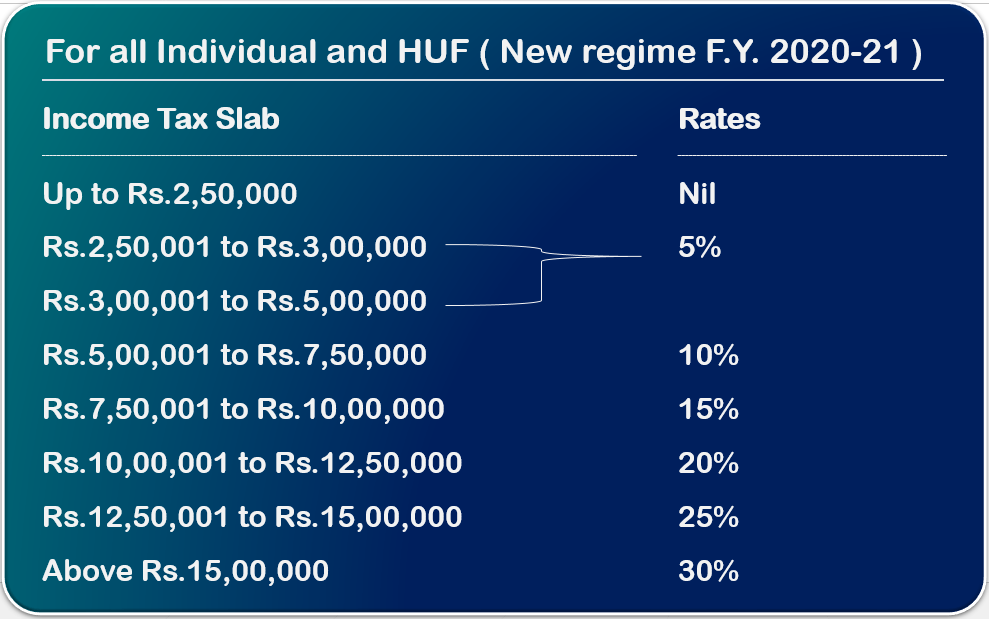

The Finance Minister has changed the income tax rate for the earning up to Rs.15 lakh in the budget 2020 for Financial Year 2020-21 or Assessment Year 2021-22. But it is optional to the taxpayers because if the taxpayers choose the reduced income tax rate than the taxpayers have to let go 70 exemptions. we are discuss this latter of this blog.

Taxpayers has an option to choose OLD or NEW tax regime.

Income tax has classified in three categories of individual taxpayers such as:

- Individuals (aged below 60 years) including residents and non-residents

- Resident Senior citizens (60 to 80 years of age)

- Resident Super senior citizens (aged more than 80 years)

Following slab rates are applicable for F.Y. 2020-21 and A.Y. 2021-22.

New Slab Rates (Optional)

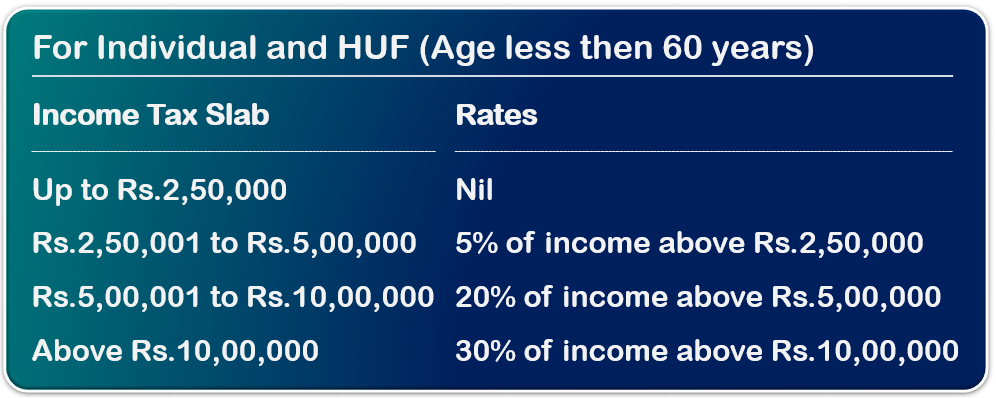

Old Slab Rates (Regular)

For Individual and HUF Age less then 60 years

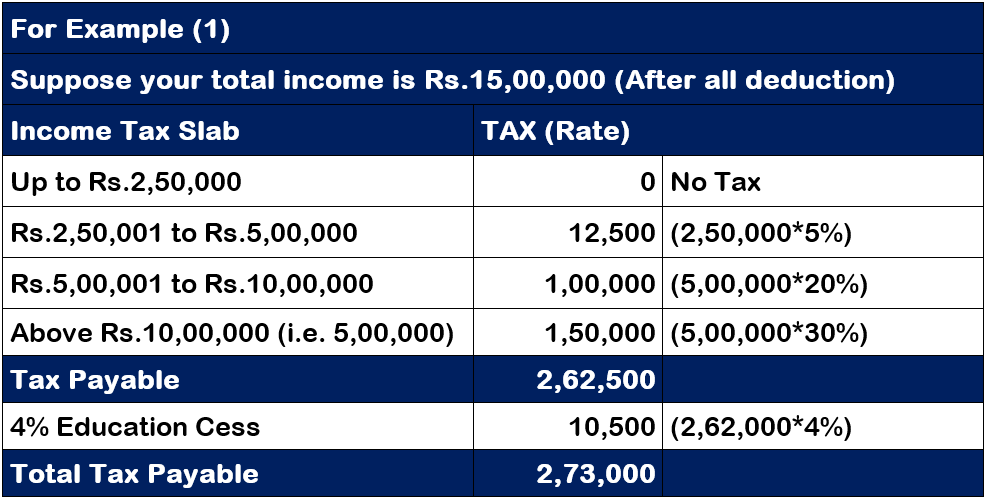

- If the income of an individual and HUF is less then Rs.2,50,000 tax is not payable.

- Income between Rs.2,50,000 to Rs.5,00,000 - Tax payable is on difference of Rs.2,50,000 i.e. Rs.12,500. (2,50,000 * 5% = 12,500)

- Income between Rs.5,00,000 to Rs.10,00,000 - Tax payable is on difference of Rs.5,00,000 i.e. Rs.1,00,000 (5,00,000 * 20% = 1,00,000)

- Income above Rs.10,00,000 - Taxable at 30% on income above Rs.10,00,000

- Health and Education cess is also applicable at the rate of 4% of Tax payable.

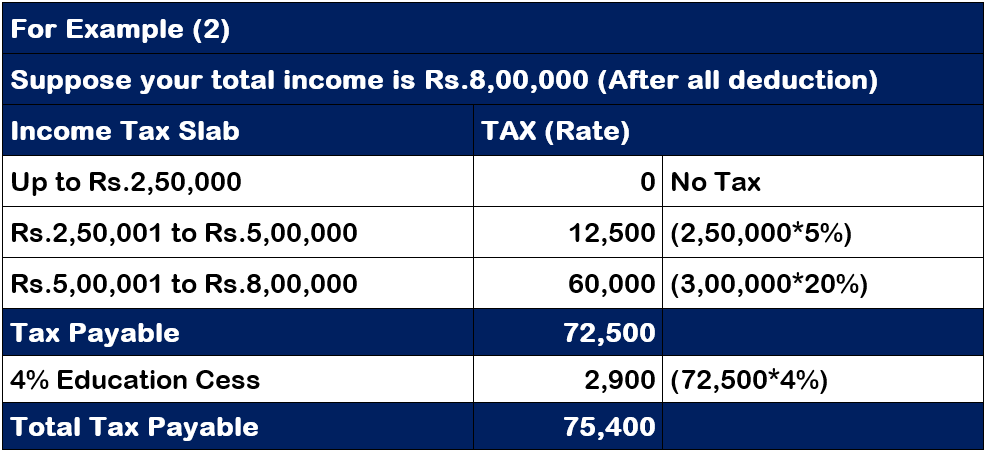

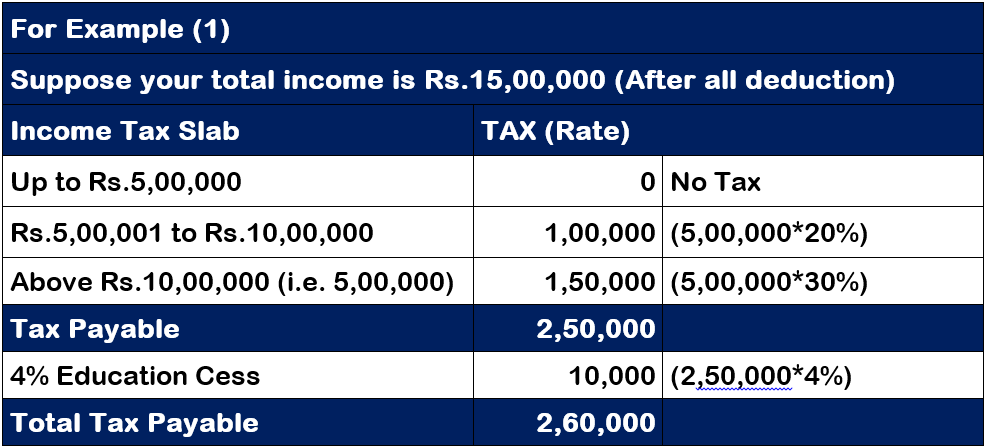

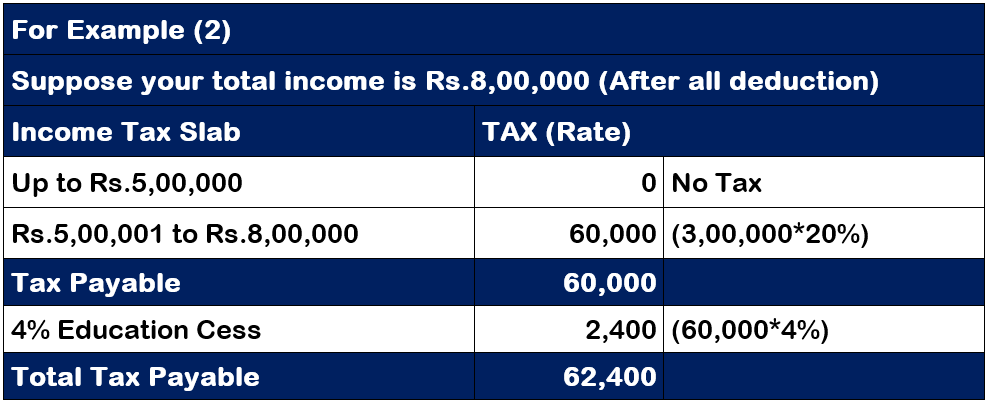

let us understand with 2 example

Example (1)

Example (2)

For Individual and HUF Age 60 years to below 80 year

- If the income of an individual and HUF (Above 60 years and above) is less then Rs.3,00,000 tax is not payable.

- Income between Rs.3,00,000 to Rs.5,00,000 - Tax payable on difference of Rs.2,00,000 i.e. Rs.10,000. (2,00,000 * 5% = 10,000)

- Income between Rs.5,00,000 to Rs.10,00,000 - Tax payable on difference of Rs.5,00,000 i.e Rs.1,00,000 (5,00,000 * 20% = 1,00,000)

- Income above Rs.10,00,000 - Taxable at 30%

- Health and Education cess are also applicable at the rate of 4% of Tax payable.

Example (1)

Example (2)

For Individual and HUF Age above 80 year

- If the income of an individual and HUF (Above 80 years and above) is less then Rs.5,00,000 then no tax payable.

- Income between Rs.5,00,000 to Rs.10,00,000 - Tax payable on difference b Rs.1,00,000 ( 5,00,000 * 20% = 1,00,000 )

- Income above Rs.10,00,000 - Taxable at 30%.

- Health and Education cess are also applicable at the rate of 4% of Tax payable.

Example (1)

Example (2)

- The maximum rebate is Rs.12,500.

Individuals whose total income Rs.5,00,000 or less they need not pay any tax.

Now lat us know that once taxpayers opted for New regime rates then they have to forgo some deduction which are as follows

To know more how up to rupees 5 lakh income tax is not payable.