GST Registration Online Process.

We are going to show how to registred under Goods and Services Tax. before we go for the process we need some basic documents for GST registration.Documents Required for GST registration online.

1.Pan card2.Aadhar card

3.Mobile No (should be registered under Aadhar) and Email ID

4.Address Proof of the principal place of business (Electricity bill or Rent Agreement)

5.Photograph

6.Bank Account details.

GST Registration Process.

Step 1: Go to the website https://www.gst.gov.in/ and click on the Registration Now button As taxpayers.Step 2: Now you can see the new restoration page. Enter the details like state, district, Pan card number, legal name of the business, Email and mobile number and code that you can see in the box and click on the proceed button.

Step 3: Now you get the OTP on Mobile number and Email ID(both are different), enter the both OTP. and click on proceed.

Step 4: Your part A of the registration is completed and your TRN number is generated. now you should complete your part B of the registration within 15 days from TRN generation.

click on proceed.

Step 5: Now click on register now button as you do before and select Temporary Reference Number (TRN) and enter the TRN number. and code that you can see in the box and click proceed.

you will get the OTP (Mobile OTP and Email OTP both are same) enter the OTP and click on proceed.

Step 6: Now you can see the dashboard. and your saved application. Click on the action

Step 7: Enter the business details. like trade name, the constitution of business, sector or ward no, center jurisdiction detail (link available if you don't know), the reason for registration, etc..

Select the commissionerate, Division, Range, Reason for registration and date on which business is started.

Step 8: Enter the promotor or partner detail. like Name, Father Name, DOB, Mobile No., etc.

Company: promotor details.

LLP/Partnership firm: Partner details

Proprietor firm: proprietor details (your name)

Enter the mobile number, date of birth, Email address, Designation or status ( in case of companies enter the DIN number ) and PAN number, aadhar number and address.

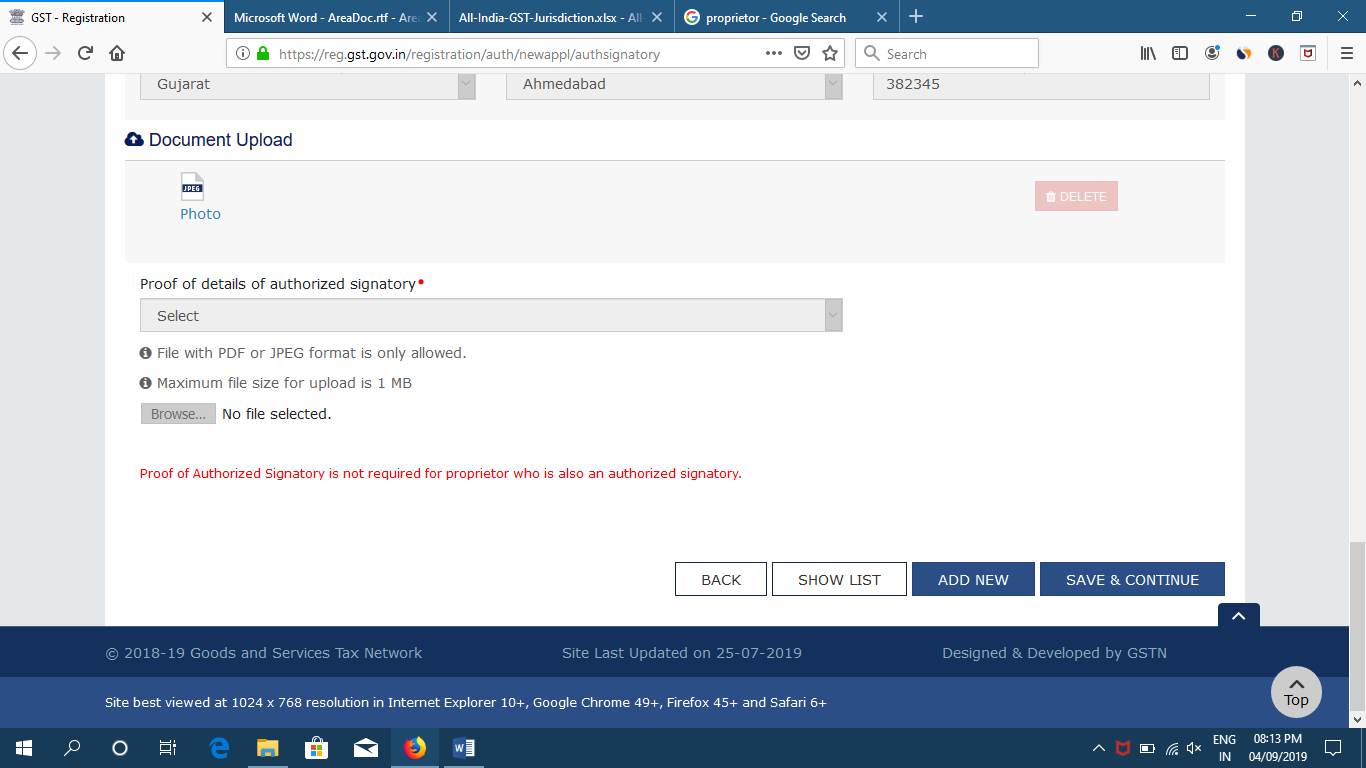

Step 9: Details of Authorised signatory and upload a photo and details of any representative if any.

Select the proof details of authorized signatory, in the case of the proprietor not required.

If you have any authorized representative put on the button and enter the details.

Step 10: Now enter the details of the principal place of business (business place).

Address, contact, nature of possession (own, rented, etc) and document of possession.

Tick mark on your business activity. if you have any other place of business then mention it.

Step 11: Describe your 5 product or service with HSN code.

Step 12: If you have any registration like professional tax, excise, then mention your respective registration number.

Step 13: Verification

Verification can be done with EVC (Aadhar OTP) or DSC (Digital signature)

you successfully submitted your GST application.

Step 14: After 15 minutes you will receive Acknowledgment. but it will take 3 or 5 working days to get your GST registration number. you will get a GST number to your mobile number or Email ID.

After getting GST number and Password from the GST portal login with it and create your new User name and Password.

Enter the new User name as you want and password and click on the submit button.

Now You can log in with your New User ID and Password.

Step 15: After the creation of user id and password you must enter your bank account details.

The total number of bank accounts maintained: 1 and fill your bank account details.

and upload proof of bank account (first page of passbook, bank statement, canceled cheque having the name of the taxpayer.) and verification should be done as above with Aadhar OTP or DSC.

You have successfully registered under GST.

Tags:Income Tax, GST

GST